A debit card can be used to build credit. There are advantages and disadvantages. Learn about the benefits and drawbacks of using your debit card to build credit. A debit card is an essential part of a healthy financial lifestyle. It is not likely to have a big impact on credit scores, but it is something worth considering.

A debit card can help you build credit.

A debit card can be used to build credit. This is an excellent option for people who are having trouble building credit. A debit card does not charge interest if you do not pay the full amount. You can still spend without worrying about your credit rating. A debit card is also easier to keep to a budget.

The greatest advantage of a debit-card is its ability to not affect your credit rating. This is especially true for those who are trying to quickly build credit. Although conventional debit cards don't contribute to your credit score, a fully-equipped debit card can help you achieve the financial stability that you need to get ahead. You will be able to debit your account and charge your purchases instead of using your card. This will enable you to take full control of your finances.

Credit cards have higher fees, but debit cards are less expensive than credit cards. There are no ATM fees and you don't need to worry about high interest rates. Some banks let you use your PIN to reduce the cost of credit card processing.

The downside to using a debit card to build credit

You can use your debit card to make payments, even if you don't have cash. This makes it easier to pay for purchases when you don't have enough cash in your wallet. This also means that you won't get overwhelmed by a large bill at the beginning your next billing cycle. A debit card is a great way for building good credit.

A debit card is different from a credit card in that the amount of money you spend is not added to your credit report. This means that it won't affect your credit score. A debit card is a great way to improve your credit rating and receive the best interest rates.

Credit score impact of using a debit credit card to build credit

Debit cards are useful for people who don't have a credit card and want to build their credit. These cards allow you to spend only what you can afford to pay back, whereas a credit card allows you to spend more than you can afford. This can lead to a decline in credit scores as the interest charges can quickly add up.

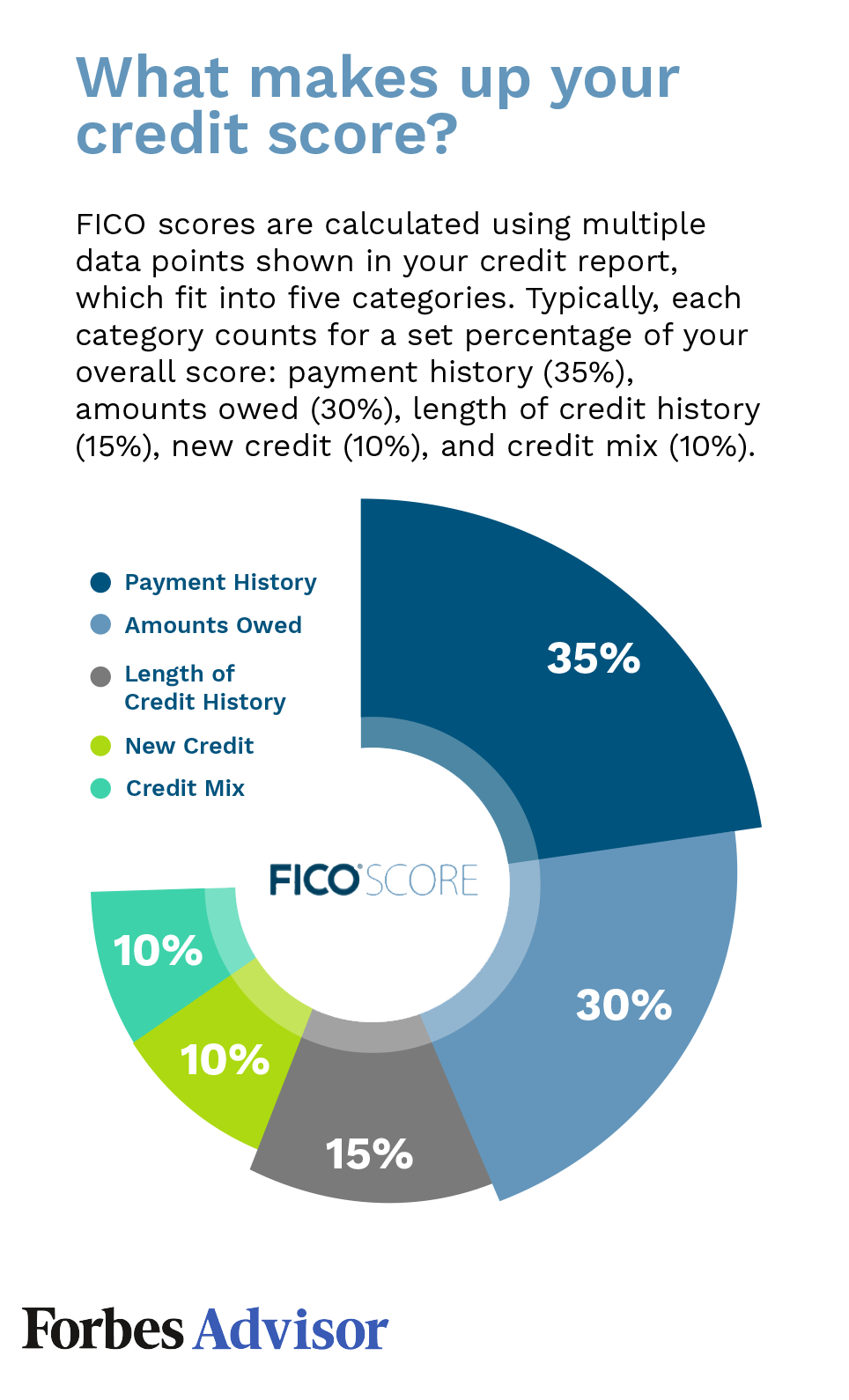

If you use a credit card to make purchases, your payments are reported to the three credit bureaus, Experian, TransUnion, and Equifax. These bureaus look at your credit report to determine how creditworthy you are. Every billing cycle, many banks offer FICO scores as a free service to their customers. You will not see the debit card transactions if you are building your credit.

A debit card is not a way to improve your credit score, but it can help you build credit. A debit card and credit card show that you are responsible. However, if you use a debit card to build your credit, the bank could close your account or report you to ChexSystems, which is an alternative credit reporting system.