Diversifying your credit mix can increase your chances of qualifying for a home equity line of credit. A variety of credit accounts can help you keep your credit utilization rate low. Adding more than one type of account will help you raise your credit score. In addition, it will boost your payment history. You can find out more about diversifying your credit here. After you have established a solid credit score, you can apply for a home equity credit line.

It can increase the chances that you are approved for loan funds

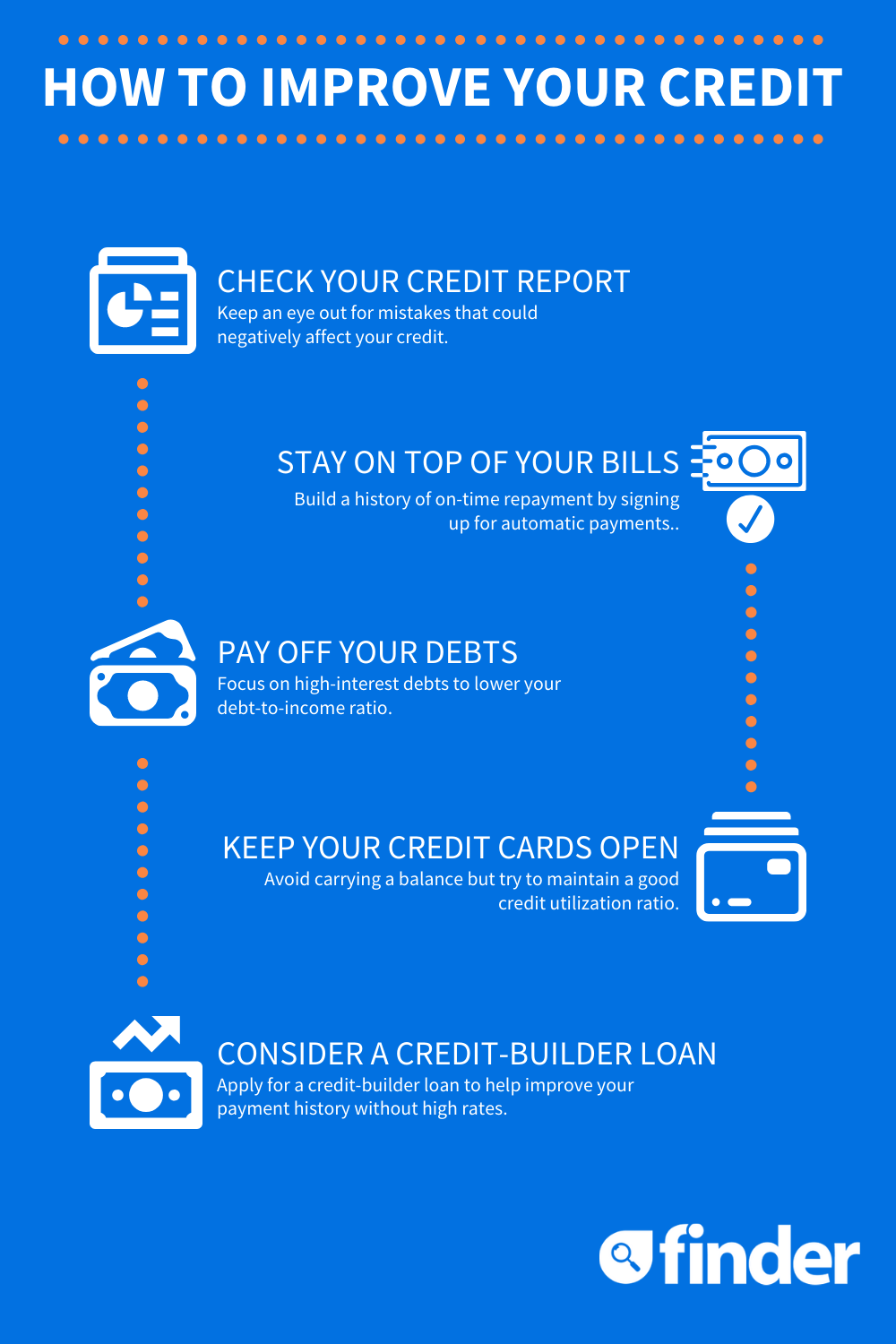

The key to your overall credit strategy is to combine your credit history. Lenders want to see a broad range of credit accounts. Your FICO score will improve if you have a mixture of old and new accounts. Do not get too excited about opening new accounts to boost your score. It's better for you to keep a healthy credit balance and not borrow money that you can't pay back.

Ideal is to have both revolving or installment credit. It is simple to manage your revolving credit and you should make sure that you pay all of your bills on the due date. It is important to not accumulate too much debt. You should only charge what you can pay each month. A small personal loan can be obtained if you don’t currently have any installment debt. This will prove to lenders that your ability to handle various types of credit.

It can help you keep your credit utilization ratio low

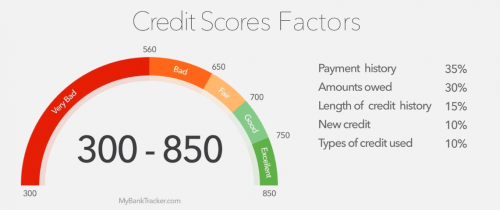

Credit utilization ratio measures how much revolving credit you have used compared to credit available on your credit cards. It is often expressed by a percentage, such 25 percent. For example, if you have $10,000 available on two cards, but you are only using $500 of it, your credit utilization ratio is 50 percent.

Credit score can be negatively affected by a high credit utilization rate. There are several things you can do to lower it. To begin, reduce the amount of credit card debt. Keep your credit card balances below 50%. This is especially important if your credit cards have multiple lines.

Next, avoid making large purchases with your credit cards. Credit card purchases of large amounts can increase your credit utilization ratio. It is important to repay these debts promptly, so they don't become due. This will ensure that you don't report a high utilization percentage to the credit bureaus. This is particularly important if you plan to apply for a loan soon and wish to keep your highest score.