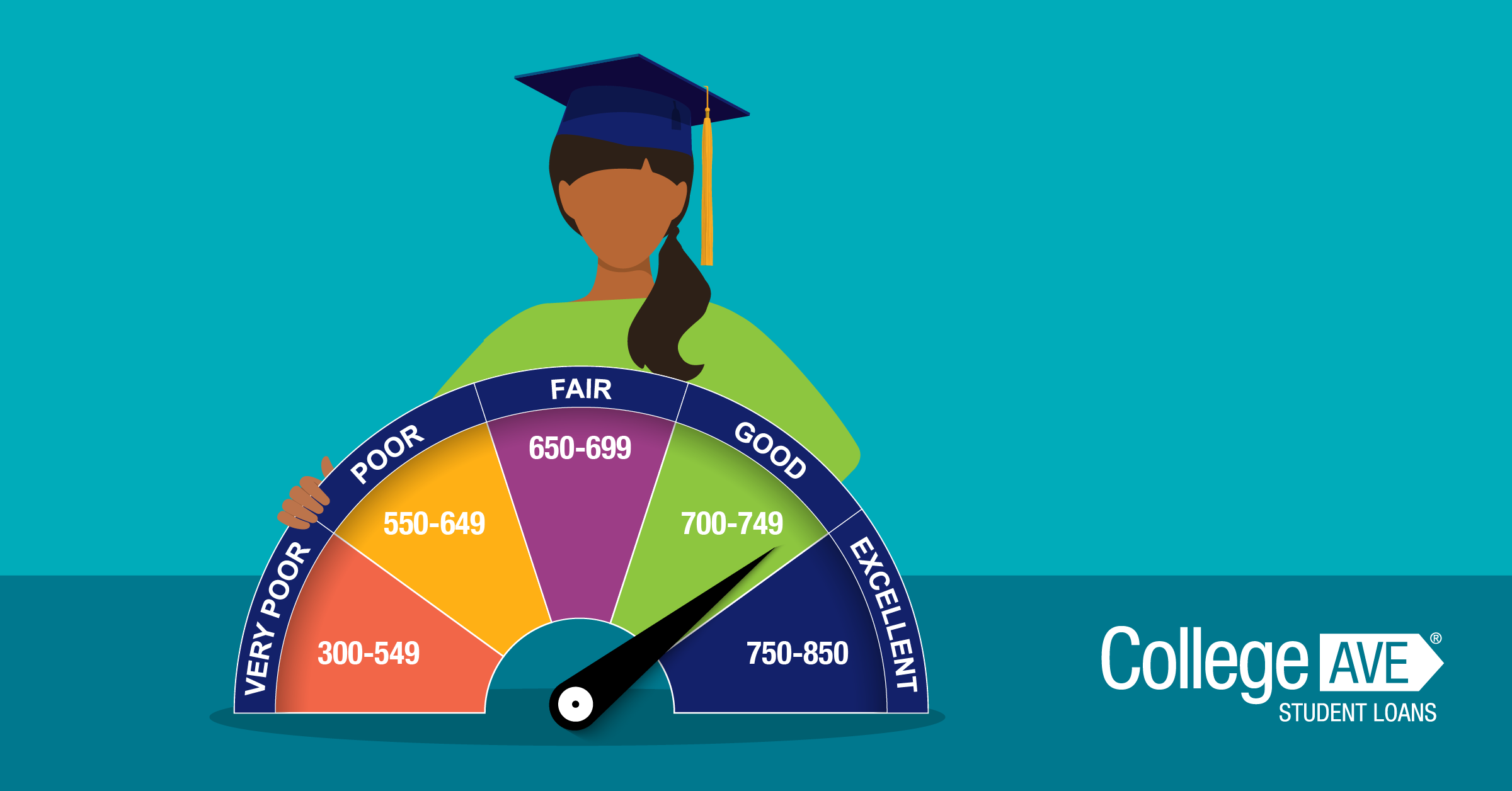

Based on credit file analysis, a credit score is a numerical representation that reflects an individual's creditworthiness. This score is based mainly on information found in a person's credit file, which is typically obtained from a credit bureau. It is a helpful tool for determining a person's creditworthiness.

Credit history length

Credit scores are affected greatly by how long you have had your credit history. Credit scores will generally be higher if your credit history is longer. Long-term payments history and a history of credit will both have an impact on your score. However, there are other factors that can boost your credit score as well.

You can get an idea of the length of your credit history by looking at how old your accounts are. Calculating the average age of all your credit card accounts and then dividing it by how many accounts you have gives you an estimate of how long ago your credit history. You should have a credit history that is at least six to ten year.

Payment history

Your credit score depends on your payment history. Your credit score can be affected by your payment history. It is important to pay all bills on time. Paying your bills on-time is important, but you also need to avoid late payments. Late payments will not be accepted back once, so it is best to pay on time. If you discover that a late payment was reported incorrectly, please contact the lender to have it corrected. Your lender might ask for proof to dispute the report, so be prepared to provide it to the credit bureaus.

The credit score's payment record is a record that shows the payments you have made in the past on various types of accounts. These accounts include home mortgage loans, installment loans and credit cards. These accounts are not the main part of a person’s credit score but they still play a crucial role in the definition of credit score.

Credit inquiries

There are two types to new inquiries on credit reports: hard and easy. A hard inquiry is a request by a lender to review your credit. This will affect your score but only temporarily. Soft inquiries are where you ask for a promotion credit card or check your own credit. Your score can fluctuate between five and five points depending upon how many inquiries are made each year.

Hard inquiries are considered less influential and account for 10% of the FICO score calculation. They are important in determining your risk to lenders. Lenders evaluate your credit score to decide whether you're a good candidate for loans. Lenders may be cautious about lending money to you if you have too many hard inquiries. However, if you have fewer inquiries and a good payment history, they may be more willing to approve you.

Type of credit

If you want to borrow money from a lending bank, you will need to know your credit score. This will help you determine if you are able to repay the loan. A credit score can include many factors, such as the age of all your credit accounts. There are two types principally of credit accounts: revolving account and installment account. Revolving account include credit cards and mortgages. Credit scores do NOT take net worth into consideration.

FICO and VantageScore have become two of the most widely used credit scoring models. These models are similar in that good FICO scores will result in a good VantageScore. Both models are used by major lenders. In 1989, Fair Isaac and Company developed the FICO credit scoring system. FICO credit scores are used by over 90 percent of top lenders to decide who to loan money to.