It's crucial to understand your credit score and what you can improve it. Free access to your credit report can help you get started. Then, you can regularly check your score to see how well it's going. You should also be aware that your credit score may change.

Request a Free Credit Report

Go to the official site and fill out a short form to receive a free credit check. You will need to enter some personal information, such as your name and address, current address, date of birth, social security number, and SSN. Some companies may also request additional information. Once you have completed all required information, you can begin the process of requesting credit reports.

Your free credit report can take up to seven days to arrive. It is best to get a copy of your credit reports as soon as possible. However, it is important to be patient. While it can take up 15 days for your request and report to be processed, you can expect your reports within that time.

Request a copy your credit report

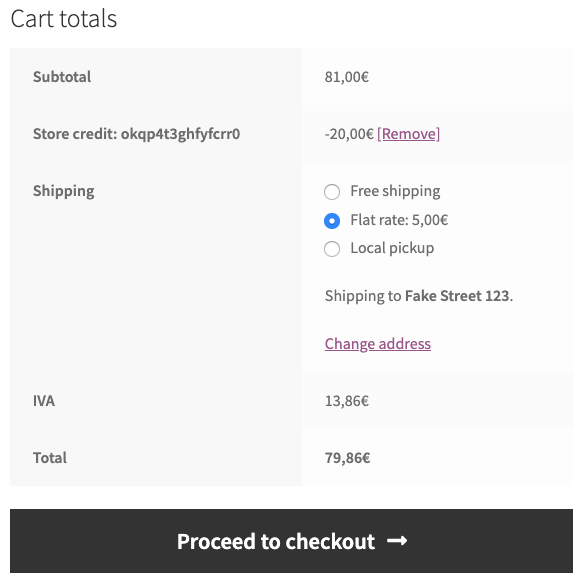

Getting a copy of your credit report will give you insight into the things that affect your score. This information is useful for applying for a loan, or to obtain insurance policies. A lender might decline you if you have bad credit. The credit report will include information on any inquiries made during the past 2 years.

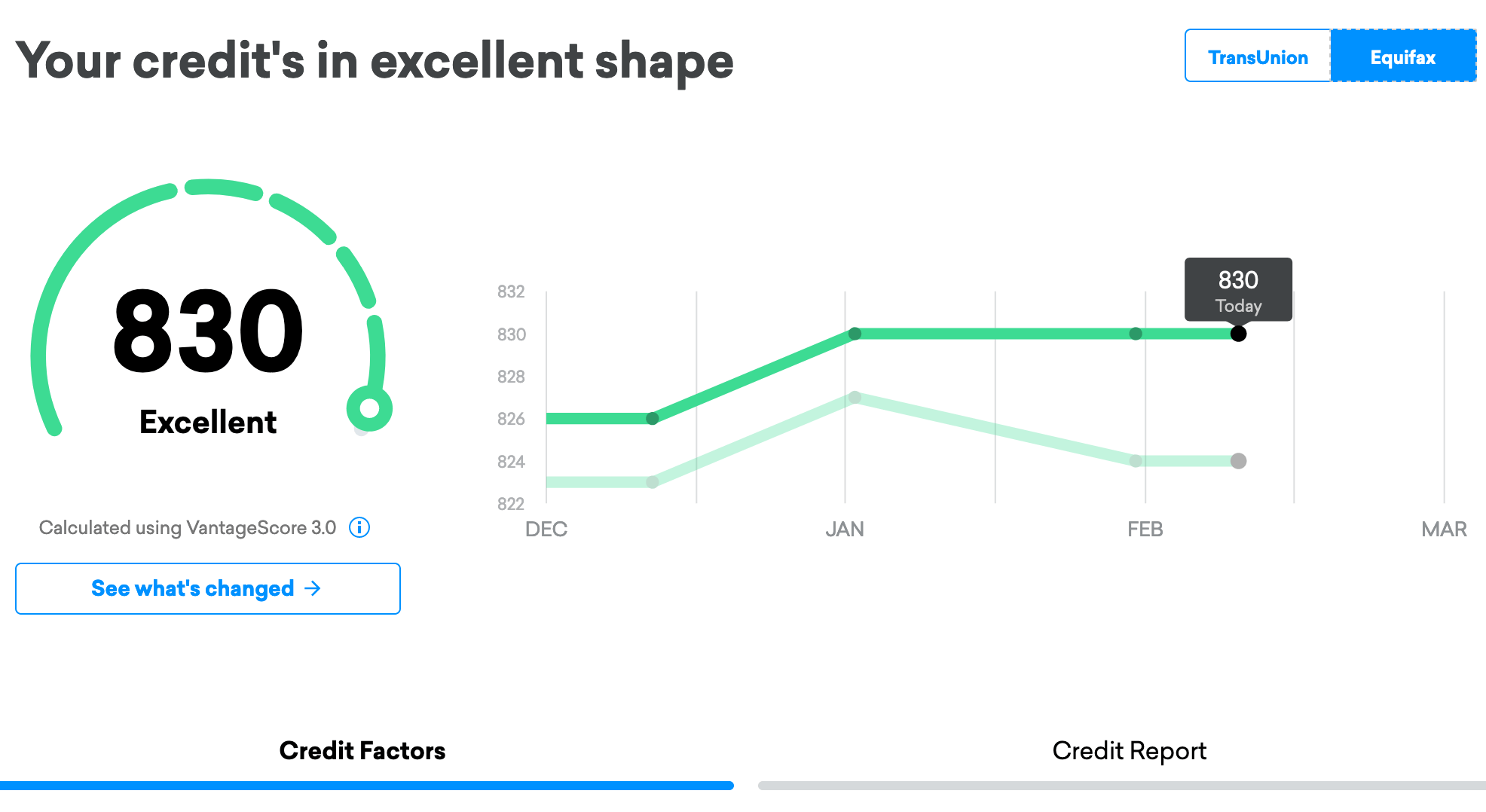

Credit score is a number of three-digit numbers that are calculated using data from your credit reports. It can range between 300 and 850. Each bureau uses different methods to calculate your credit score. It is a reflection of how likely you are to repay a loan.

Checking your credit score regularly

If you're in good financial shape, you probably already know that checking your credit score regularly is an important part of keeping your finances on track. NerdWallet's study found that nearly two-thirds don't review their credit reports each year. You can avoid identity theft by keeping track of your credit report. Your report contains information about your current and past addresses, employers, and many other public records.

It is a good habit to check your credit score frequently. This will help you avoid identity theft. This happens when someone impersonates another person to steal their personal information such as a social insurance number. The information is then used to make financial transactions that use the identity of that person. A high credit score will help you avoid potential theft and protect your financial future.

A good credit score is essential

In today's financial world, a high credit score can open doors to many financial opportunities. A high credit score will enable you to get loans at lower interest rates. Your chances of getting hired are also affected by your credit rating. You are more likely than others to be hired by a great company if you have a high credit score.

A good credit score is important when renting an apartment or buying a house. Lenders and landlords can see your credit history to determine if you are a risk. Higher rates of mortgages will be available to those who have good credit and can pay their bills on time.