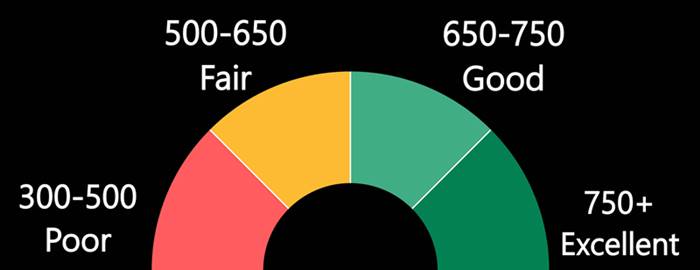

Having a good credit score is important for many reasons. A good credit rating makes you appear less risky than someone who has a poor credit history or has a low credit score. A good credit score can also impact your ability and ability to obtain certain services, as well as your ability to find housing. The third aspect of credit is how it can affect your livelihood.

Good credit has many benefits

Credit score is key to many benefits offered by credit cards. High credit scores can lead to lower interest rates and more rewards. Credit scores are also considered by insurance companies when determining the premiums for your policy. High credit scores indicate that you are less risk to the insurance company.

Credit can be used for many things, including the purchase of a new house or car. This credit can also help you qualify for jobs and get lower interest rates. Your credit rating can also make renting or leasing an apartment easier. You might be eligible for a utility account with no security deposit.

Bad credit is costly

Bad credit can limit your ability get loans and credit cards. You will have to pay more interest on any loan with bad credit. Lenders use credit scores as a way to assess risk and to decide whether you can pay back the loan. Lenders consider borrowers with lower credit scores higher risk as they are more likely default on their debts or to miss payments. However, the higher interest rate will help to offset this risk but also limit your cash flow.

Higher interest rates on loans may mean that you pay higher deposits to get a card. You may have to pay higher deposits from some utilities than others. You may not be able to access premium plans and services. It is possible to lower the cost of poor credit by learning how you can improve your credit and maintain a high credit score.

A credit card with a low interest rate

If you have good credit, you may be able to get a low interest rate on a credit-card account. These cards are great for those who want to have high purchasing power while not paying high interest rates. It is important to remember to always contact the credit card company to request a lower rate if the current rate you are currently paying is too high.

The best way to find a low interest card is to compare offers from different lenders. Start by calling your bank or credit union to get a list with credit card offers. Compare the variable APR and perks of each offer. Pay attention to whether foreign transaction fees are included in the card.

Get a store creditcard with no security deposit

A store credit card comes with no security deposit and offers many benefits. First, the card can be used to make purchases and not require a security deposit. You can also transfer the card to another credit card or to a bank account. There will be a charge for service and a transfer fee. Moreover, if your credit score is too low, you should consider saving up for a big purchase in advance.

Many store credit cards have special features that are available to those with low credit scores. These cards allow for cash deposits, instead of a security payment. You can also get extra interest on money you spend. Your score will improve if your payments are on time and you pay the extra interest back. Moreover, once you improve your credit score, you can apply for a regular credit card. Experts caution against store cards that offer poor terms. Instead, look for a card that has easy terms and lets you shop.