Credit can be a big help, whether you are trying to find a good rate for car insurance or buying a house. If you have a high score, you are more likely to qualify for lower interest rate loans and credit cards, saving you money throughout the term of the loan.

Credit history impacts every aspect of life. It can affect your job search and apartment rental. Your employer may review your credit even if you are not applying for a credit card. They want to know if your attitude towards paying bills on time is responsible.

If you want to improve your credit score, you'll need to make payments on time and in full. Credit Strong's credit builder loan is easy to manage, and will not harm your credit score as long as your payments are made on time.

Credit Strong has three credit builder programs that will help you improve your credit score and begin saving money while improving your credit. Each of these products includes a free monthly FICO(r) Score 8 to help you track your progress.

Credit Strong's credit builders loans do not require you deposit any security. Credit Strong credit builders loans allow you to select a term and loan amount. You can then choose your monthly payment plan.

Credit Strong earns its money by dividing each monthly payment between principal (to build your credit) as well as interest. You'll receive a Credit Strong Lock at the end of the plan.

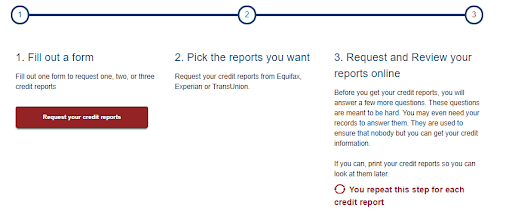

Credit Strong reports your monthly payment to the three major credit bureaus. You're thereby building up a credit history, and you are also increasing your credit score. Your payment history and credit score will increase over time, as long as you make your payments on time and in full.

If you choose to cancel your credit builder loan before the end of its term, you'll receive a refund for all of the money you put down toward the principal portion of the loan. However, you will lose the money that you paid towards interest and the administration fee.

Credit Strong will not charge you a penalty if you cancel before the 25-month period. Credit Strong requires advance notice if you want to cancel. Otherwise, they will not reimburse the interest already paid.

Credit Strong customers who canceled early have been charged a significant amount of money for the money they paid to the principal portion of their Credit Builder loan. Some people may find this option unsuitable, particularly those who have limited funds or want to save money on credit builder payments.

Good credit scores are the first step towards financial freedom. You can get a job better, have more credit available and pay less interest on your debts with a strong credit score. Additionally, a high credit score gives you more choices in your financial and lifestyle.