Here are some key points to consider when maintaining a high credit rating. First, your utilization ratio is an important aspect of your overall score. It can negatively impact your score if you're not paying your bills on time, so limiting it is vitally important. You should also pay any collection or charge-offs you might have. Also, try to keep your credit utilization ratio under 30%.

In order to negatively impact your credit score, it is important that you pay all bills on time.

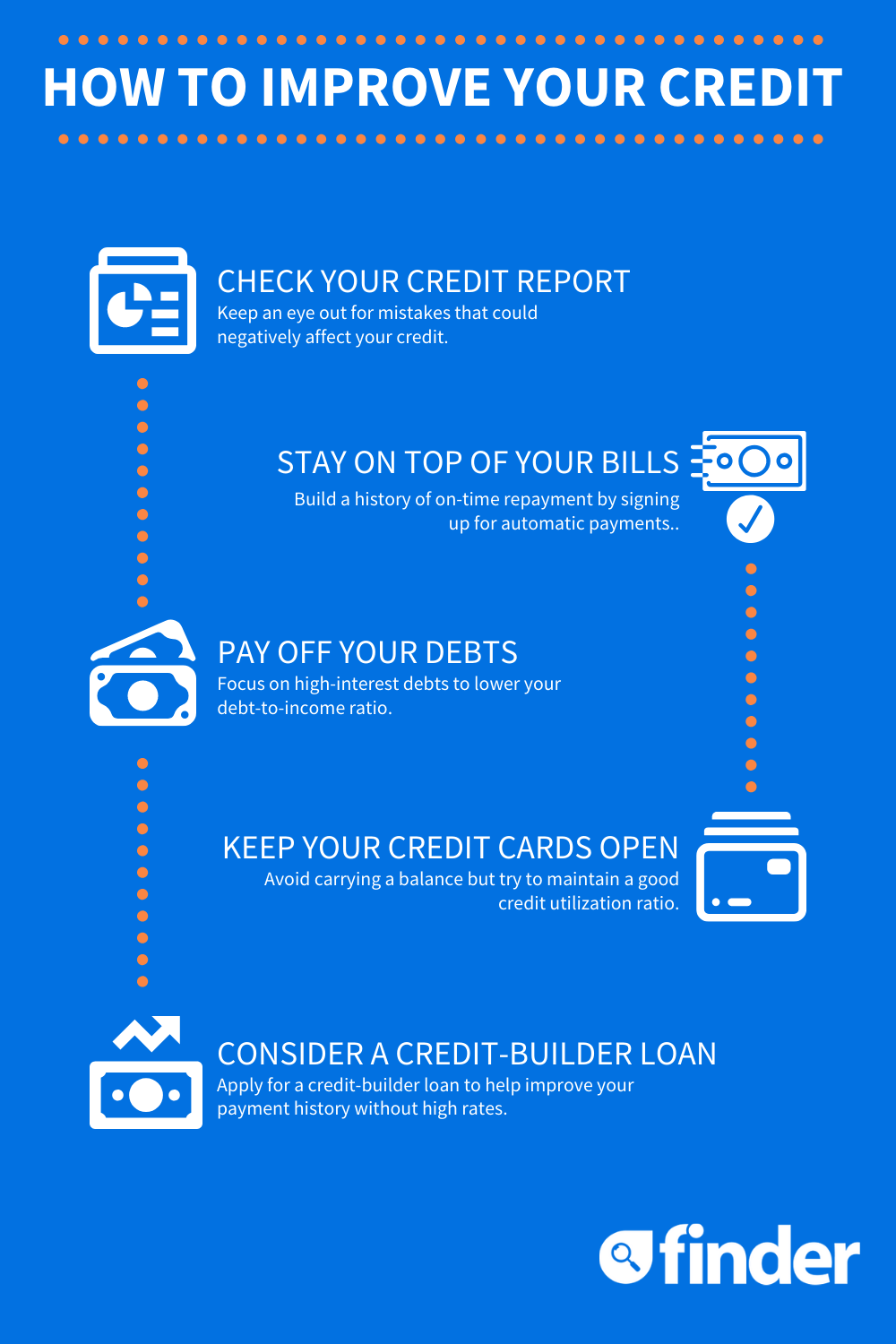

Your credit score will be affected largely by how prompt you pay your bills. Some late payments will not have an impact on your credit score but others could. There are many ways to improve your credit score, and avoid paying late payments. The first step is to learn more about the ways that late payments can affect your credit score. Access your credit report free of charge.

Making timely payments is vital if your credit card has a balance. Your credit score can be negatively affected by even one late payment. The longer your late payment is, the more likely it is that you will be flagged as a risk for future late payments. A late payment will appear as an entry on your credit report for seven years. If you pay late, you will be charged more interest.

Repayment of charge-offs and collection accounts

You can maintain good credit scores by paying off any collection accounts or charge-offs. It is not easy. Get caught up on past payments first. The next step is to get caught up on past due payment. This will slowly diminish the effect of late payments and you can improve your score.

If possible, negotiate a settlement with the original lender. Ask for a letter of confirmation proving that the debt was paid. This will be recorded on your credit reports as a charge-off paid. Lenders generally consider this more favorable than an unpaid account. The same applies to debts you pay off to be sold at a collection agency. You need to make sure that the details of your final payment letter don't show up on your credit reports as a charge.

Keeping your credit utilization ratio low

To improve your credit score, you need to keep your credit utilization low. NerdWallet, a free service that tracks your credit usage, can help you determine how much. Ideally, you should keep this number below 30 percent. This ratio can change with each purchase.

Your credit utilization ratio is calculated by dividing the amount of credit you have available to you by the total number of outstanding balances on your accounts. Although this number may not be exact, it is an important factor in your overall score. Low credit utilization will enable you to get credit when you need it, and help you achieve your money management goals.

Avoid asking too many questions

To maintain good credit scores, avoid asking for hard inquiries. Lenders can pull your credit report if you apply or make large financial obligations. While it may seem innocuous at first glance, this action can affect your credit score. Hard inquiries, which are listed on your credit report, can cause your score to drop by several points.

There are several ways you can avoid difficult inquiries. The first is to not apply too many for credit cards. Applying for too many credit cards will result in too many inquiries and lower credit scores. Consider whether you really do need a new debit card, or if it is possible to better manage your current credit.