When looking for a mortgage loan, your credit score is important. Your credit score should not be lower than 720. A majority of mortgages in America are secured by borrowers who score in the top 50% of the range. The average credit score of those in the 50th percentile range is 760.

720+

If you are considering a mortgage, a credit score of at least 720 can help you obtain a lower rate of interest and better terms. A credit score in the 720+ category is considered "very strong." You may be able to qualify for a mortgage at a lower interest than a score of 620. It can also help with your eligibility for top credit cards with low rates of interest.

The best borrowers for mortgage lenders are those with strong debt management and a long credit history. A credit score above 720 will allow them to assess your credit risk, and then offer the lowest possible interest rate. Lending industry considers 720+ credit "excellent", while 760+ credit will give you the lowest possible mortgage rate.

760+

People with 760+ credit ratings are most likely eligible for the best mortgage rates. There are many ways to achieve these scores, but the most important thing is consistency. This means paying your bills in time and managing your credit responsibly. Keeping track of your progress is also important. You can track your progress using WalletHub's credit score tracker.

Mortgage lenders look at your FICO credit score to determine your eligibility for the best mortgage rates. The best mortgage rates were historically available to borrowers with credit scores greater than 720. To get the best mortgage rates lenders are now more demanding of borrowers with credit scores below 720.

720

Minimum 720 credit score is required to qualify for the lowest mortgage rate. A higher credit score will allow you to qualify for lower rates and better terms. An increase in credit scores can help you qualify for a better underwriting group.

In the past mortgage rates were not available to everyone. Nowadays, lenders will require that you have a credit score of 740 to 760. However, a lower credit score will not have a significant impact on your application.

620

When looking for the best rate on a mortgage, a 620 credit score is a good starting point. Remember that different mortgage programs may require different credit scores. For example, a government mortgage might have a lower credit score than conventional mortgages, or vice versa. A mortgage loan agent can help you decide the best mortgage option.

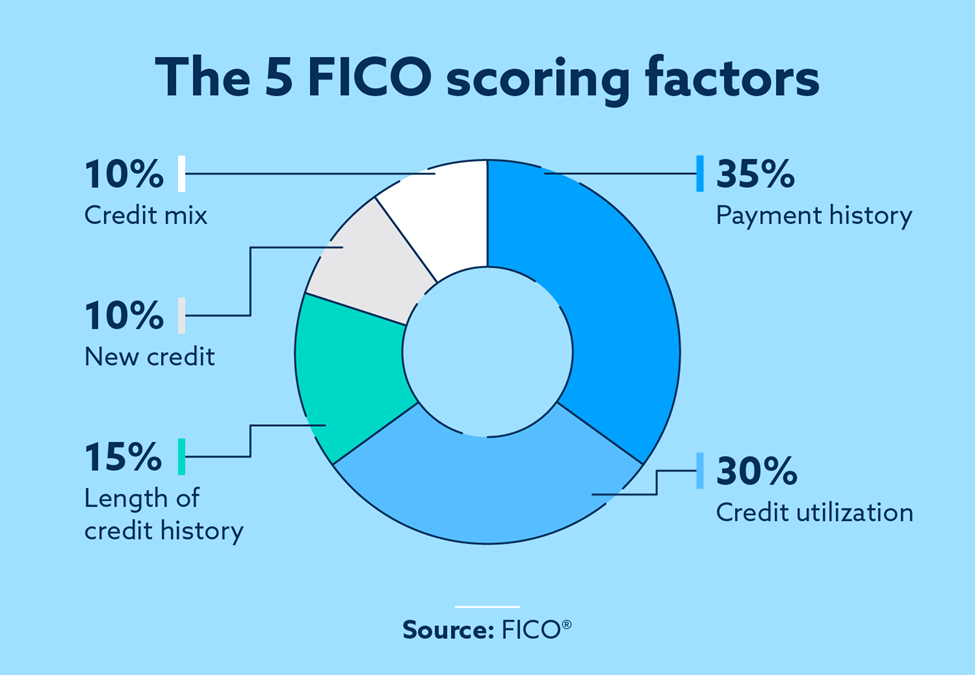

To determine creditworthiness, most lenders use VantageScore and FICO scoring models. These models include factors such as credit card debt and debt-to–income ratios. Low credit scores can lead to higher interest rates, but you may still qualify for a mortgage if your score is below 620.