Your credit score is a key factor in the mortgage application process. Having a good credit score can mean the difference between getting approved for the mortgage you're after and living in an overpriced apartment. Credit scores are still a mystery. You may not know the exact score, even if you are certain. There are steps that you can take in order to improve your score.

Get a free credit report

An important step in the process of getting a home loan is to obtain a free credit report. This will enable you to view your credit score as well as any mistakes. A free report should be requested at least six months in advance of making large purchases. Rebuilding your credit can take a while.

You can request your report from the federal trade commission, or you can do it yourself through the mail. The process will take around 15 days. To request the report, you should use the Annual Credit Report Request Form. You can also request a free credit report at any major credit bureau.

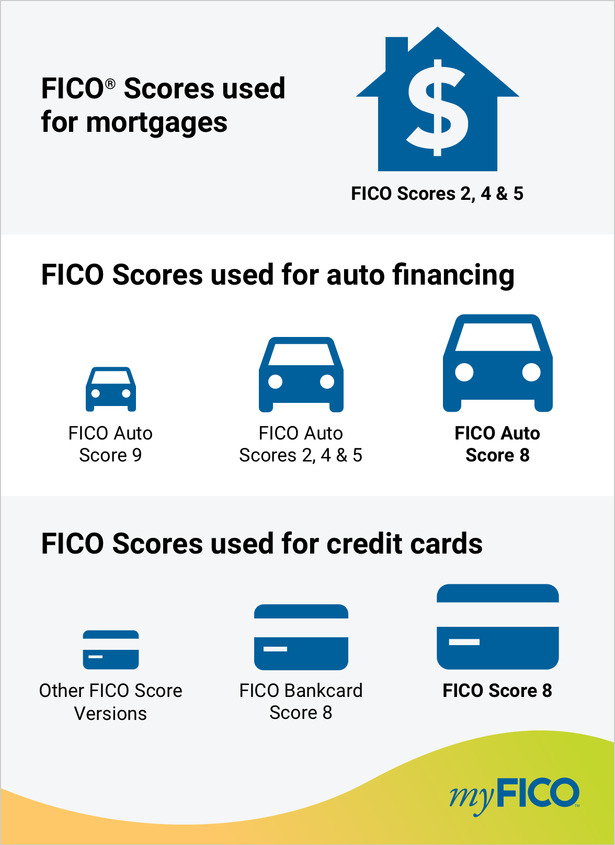

Calculating your mortgage credit score

Two factors play a significant role in your mortgage credit score: credit utilization, and payment history. You can hurt your credit by late payments, but paying all of your bills on time will help you improve your score. Credit utilization is the ratio of your total debt to the amount you have available. A $1,000 credit line with $500 remaining is a 50% credit utilization rate. A credit utilization rate of 30% is the ideal.

Although different credit scoring methods are used by lenders, the core factors remain the exact same. A mortgage lender's credit score will be much lower than your own. A key step to improving credit scores is checking your credit report regularly.

Credit monitoring services

Credit monitoring services can be a good option if you are looking for a mortgage. They will help you to track your credit score and improve your chances of approval. Although they won't prevent criminal activity or identity theft, these services can alert you to suspicious activity. This gives you peace of mind, especially if you're about make a major purchase.

Credit monitoring services are commercial services that scan your credit reports and alert you to any changes. Fraud and identity thieves are on the rise. The Federal Trade Commission forecasts that 44.7% of all cases will increase by 2021. A credit monitoring service will help you detect unauthorized changes in credit reports such as new loans or credit cards. There are both paid and free credit-monitoring services that you can use to identify unauthorized changes in your credit reports.

Lower mortgage credit score

Before you apply to a loan, be sure to check your mortgage credit score. Low credit scores are a sign of financial trouble. Adding another mortgage to your debt pile is not a wise idea. Low credit scores can make mortgages more expensive and lenders will charge higher interest rates in order to offset the risk. Wait until your credit score improves before you apply to mortgage.

You can improve your credit score by reducing your debt. Your credit card balances can be paid off to lower your debt usage and increase equity in your house. This will increase your credit score before applying for a mortgage.