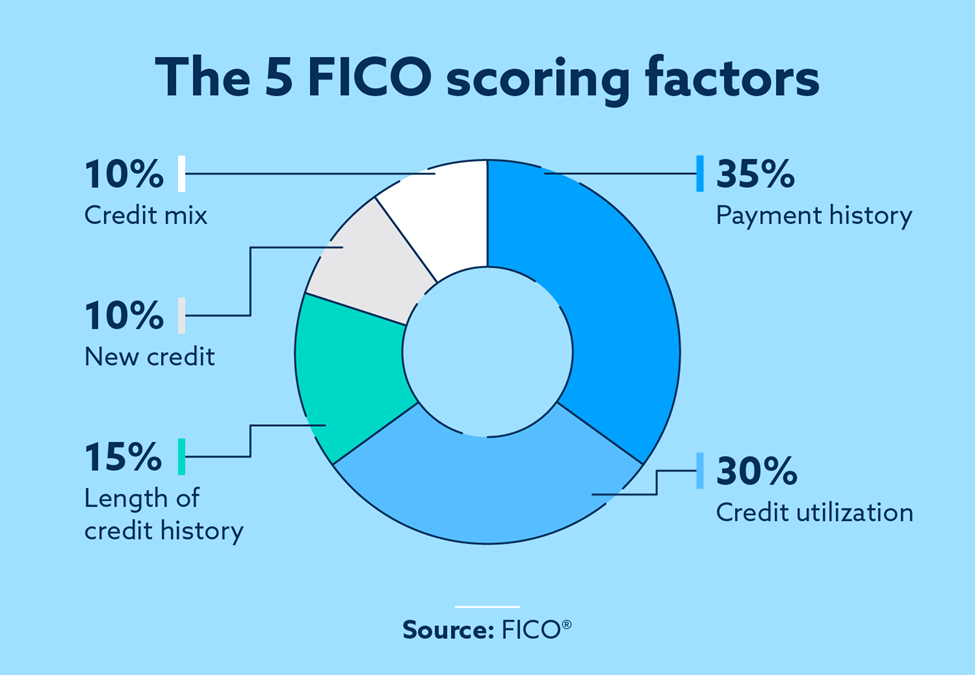

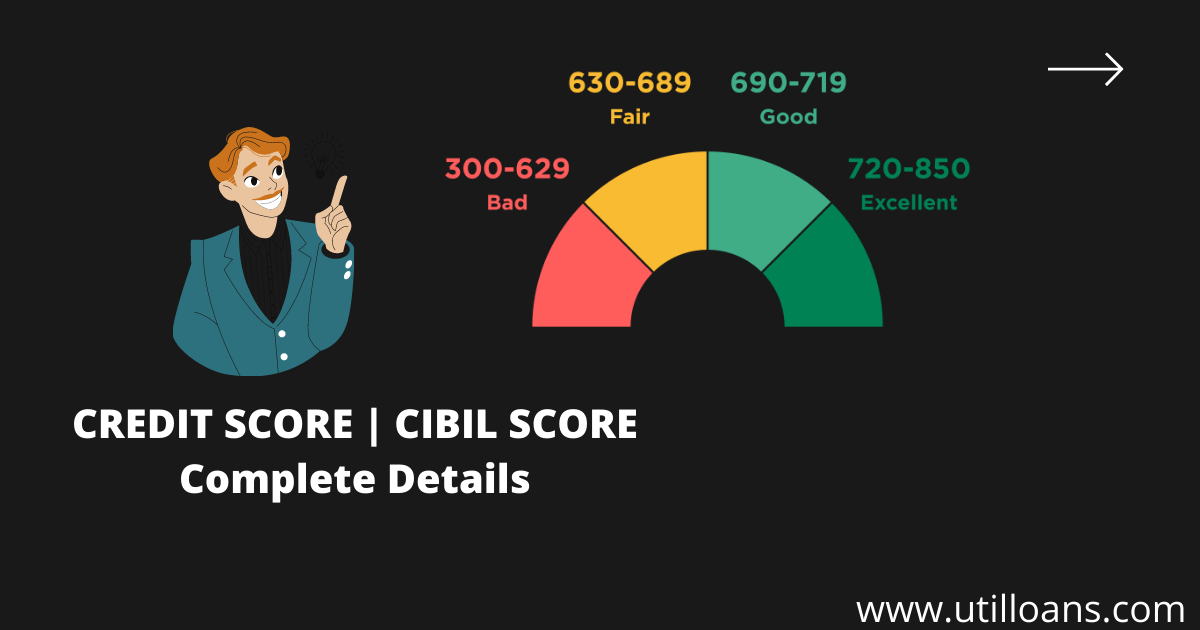

It is vital to maintain the highest credit utilization ratio in order to receive the best credit card offers. Your credit score is more than just a consideration by lenders. Employers also have the ability to use it to determine your compatibility with particular positions. A high credit utilization rate could limit your chances of finding the perfect job. There are many ways to reduce credit utilization, and keep it down.

Keep your credit utilization rate below 30 percent

One of the most important things you can do to help boost your credit score is to keep your credit utilization ratio under 30 percent. Credit utilization simply measures how much credit your use relative to credit available. Logging in to your credit card account can reveal your credit utilization rate. Once you have a rough idea of your credit limit, you can divide it by the amount of your outstanding debt. Then multiply that number by 100 to calculate your credit utilization ratio. You have ample credit to pay off all your debts if you have low credit utilization.

The credit utilization ratio is calculated using credit cards balances. It is updated once per month around the time you receive your monthly statement. Here are some tips to help you keep below 30 percent.

For a lower debt load, you can apply for a brand new credit card

You can increase your credit limit by applying for a credit card. This will also lower your credit utilization ratio. However, this may not improve your credit score. To improve credit utilization, the first step is to pay off your existing debts. There are many things that can lead to you spending more than you have money. This can wreak havoc on your finances. The second is that you can open a new account to increase the number of accounts on your credit report. This will impact your score.

Your credit score can be affected if you apply for too many credit cards. A high credit utilization percentage means that you "live on credit" which can be financially dangerous and more risky for lenders. This is why it's critical to avoid the temptation to max out your credit cards. Fortunately, new credit cards can help your credit score if you use them responsibly.

Restore credit utilization ratio by paying off outstanding debt

Current debt repayments are one of the most effective ways to increase credit utilization. Paying down your debts will decrease your interest rate and lower your total debt. You can consolidate your debt, or take out personal loans to finance large purchases. Personal loans are also known as installment loans. This means that you will have to repay a certain amount and pay a fixed repayment period. You are free to spend the money however and whenever you want.

By paying off your credit card debt and lines of crédit, you can increase credit utilization. It is best to pay off your credit cards and lines of credits as soon as possible. High utilization may result in your credit rating being lower. You won't lose your payment history if your current debt is paid off. This is especially important if your goal to get a new line credit.

To reduce credit utilization, increase credit limit

You can reduce your credit utilization ratio by paying off your credit card debts. This will decrease your overall debt as well as eliminate interest costs. You can also increase your credit score. It's easy to calculate this ratio by simply dividing your total credit cards balance by your total credit limit.

Applying for a second credit card will allow you to increase the credit limit. This will allow you to access more credit and reduce your credit utilization ratio. However, it may not improve your credit score. This is because having more credit cards can tempt you to spend more than you can afford. The number of credit cards you have on your credit report will increase, which will impact your score.