Secured credit cards are credit cards that require you to make a refundable deposit before you can use them. These cards are often used to provide proof of credit history and a stepping stone for an unsecured card. A secured credit card requires that you make a deposit of a certain amount with the issuer. Be careful with your spending. Limit your purchases on these cards to just a few per month, and ensure that you pay off the balance on time.

Secured credit cards require a refundable deposit

A small deposit can be made if you have a strong credit history and want to apply for secured credit cards. A $250 security deposit will give you more control over your cash than a larger one. The security deposit can't be refunded, so it could prove difficult for you to access it in an emergency. In addition, if you are unable to make your monthly payments, you may have to cancel your card.

If you don't have any credit or have poor credit, secured credit cards might be a good choice. Some cards don't require credit checks but may charge higher fees. You will be required to submit your bank account information to the credit card issuer to get a refund. In some cases, the issuer will give you a statement credit for your new unsecured card.

They can be used as a starting point to an unsecured credit card

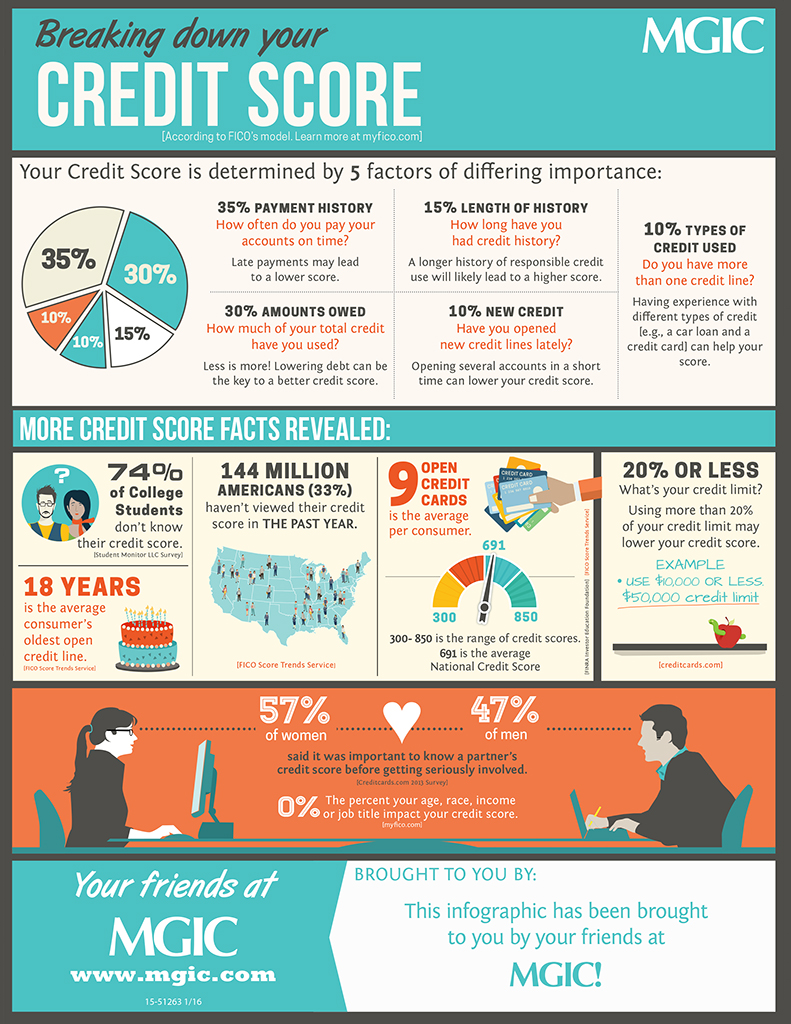

By making regular payments to your secured card, you can upgrade to an unsecured card. You will be able to apply for an unsecured credit line from your card issuer by increasing your credit score. A credit score of at minimum 580 is an ideal requirement. You should also have a credit utilization ratio of less than 30%.

Secured credit cards help you establish credit and teach good credit habits. However, it is important to remember that they are not a permanent solution for repairing your credit. Many people eventually upgrade from an unsecured credit to one.

These prove that lenders require good credit records

Secured credit cards are one way to establish credit history. Many secured card issuers are reluctant to issue cards to people who have been in bankruptcy, have high debt, or have low income. Bankrate's CardMatch tool allows you to verify if your application is eligible.

Certain secured credit cards let you automatically increase the credit limit after you have made on-time payments. This increases your purchasing power and improves credit scores. A FICO score of 670 and above is considered "good" by lenders.

They are also more accessible than unsecured card

If you want to improve your credit rating, a secured card might be the best option. They are easier to get than unsecured credit cards. If you are unable to pay your bill, the issuer will keep a deposit in an account. These cards are also better for people with bad credit, since they can help rebuild their credit history over time.

Unsecured credit cards are harder to obtain and have a higher risk. If you have bad or no credit, you may find it difficult to get approved, even for a small line of credit. High non-refundable fees may be required. This could lead to an account with an interest rate that is higher than your credit rating.

These can help build credit

Secured credit cards are an excellent way to get started building your credit history. These cards report monthly information to the credit bureaus and help you build a good history. You can build credit with a secured bank card by paying your bills on time. Keep your account open for as long as possible to build a solid credit history.

If you know how to manage secured credit cards, they can help you build credit. Remember to make your monthly payments on time and don't spend more than 30% of your credit limit. Secured cards are useful for those with bad credit or trying to rebuild their credit. They report to the credit agencies each month and have very low annual fees. You don't need to deposit any money or pay an annual fee for the best secured credit card.