Citi secured credit cards offer many benefits. There are no annual fees, flexible payment due dates and 0% APR. Other cards have no responsibility for fraudulent purchases. Read on to discover more about these cards and how they can benefit your financial future. After all, no one wants to have a credit card that won't help them build their credit.

There is no annual charge

Citi Secured Mastercard can be used worldwide at millions of locations. It is designed for people with limited credit, bad credit, or no credit at all. The cardholders are free to make on-time payments and build their credit score.

The Citi Secured Mastercard has no annual fee and is a great way to start building your credit history. It automatically reports to the three major credit bureaus monthly and provides free online access to your FICO score. The card is accepted everywhere and does not require an annual fee.

Flexible payment due dates

Citi credit cards have flexible payment due dates and are great for those who have trouble paying their monthly bills. These cards give you a lot of flexibility in how you pay, and they also help you build your credit history. Auto Pay is a way to automatically pay your bills, so there's no need to worry about missing a payment.

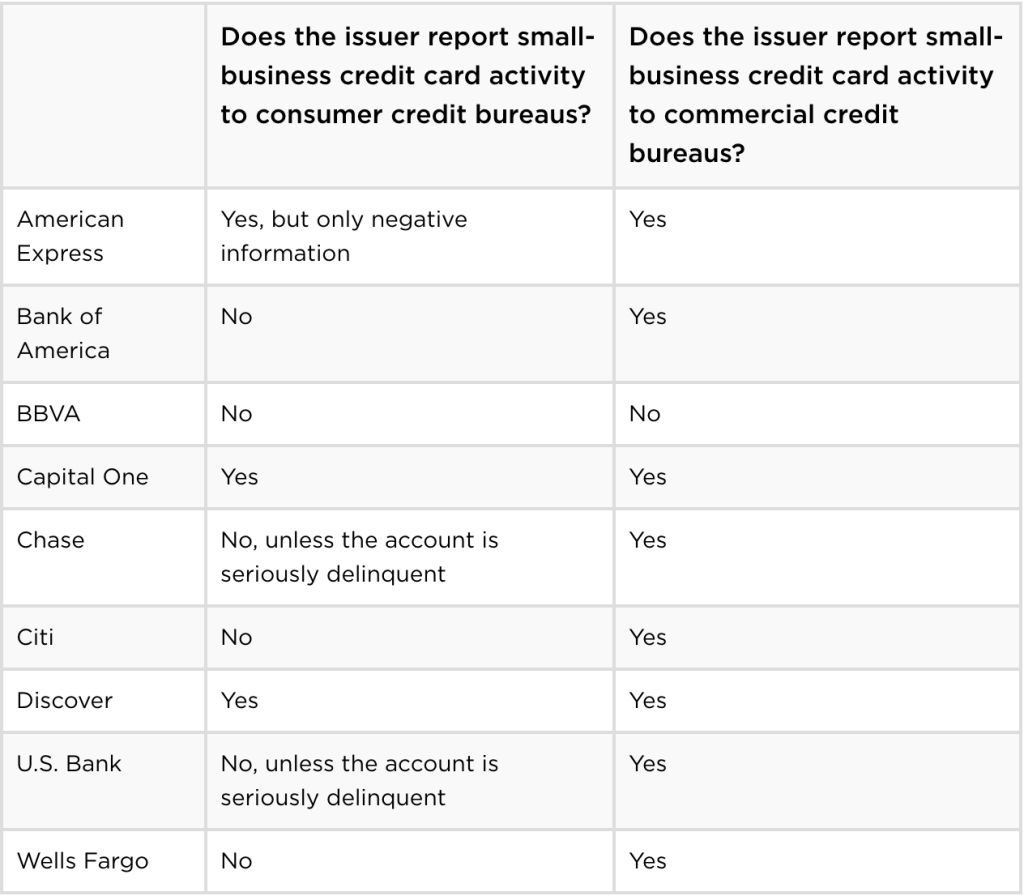

You can also report your spending activity and payment information to the major credit agencies. You can improve your credit score and build good credit. Pay attention: You can damage your credit history if you miss a payment or use it for large purchases. Don't overuse your card as this can seriously damage your credit score.

For fraudulent purchases, you are not liable for any amount

A credit card that has zero liability for fraudulent purchases is a great idea if you are concerned about fraud charges. Each issuer has different policies and they are all explained on their website. If you suspect that your account was misused, you can call the company directly. Some cards also offer 24 hour monitoring, which can be used to identify fraudulent charges. You may also be able send secure messages and texts to confirm purchases. If you are unable to verify the charge within 60 days, you could be held responsible for the entire amount.

You also get 24/7 customer service and flexibility with payment due dates on a credit card that is zero-liability for fraudulent purchases. Citi credit cards have zero liability for any unauthorized purchases. Citi Identity Theft Solutions also provides identity theft assistance for free. It can help you if you have your identity stolen. Citi cards also monitor your account for suspicious activity and contact you if any are detected.

0% APR

If you've had credit problems in the past, a 0% APR Citi secured credit card can help you rebuild your credit score. You will need to make a deposit between $200 and $2,500 to get the credit card. This amount can be refunded if you decide not to use it. You also get a user-friendly app and flexible payment terms. A secured card does not earn rewards but it's a great choice for people with poor credit or limited credit histories.

Citi will check your credit history and report your account activity to the credit bureaus, which can help you get better interest rates. Online applications are required to apply for the card. This can take around four weeks. After you have received your decision, it will take seven to ten days for your card to be sent to you.

No foreign transaction fee

Citi Secured Mastercard has no annual fee and is a great credit card. To get the card, you need to make a $200 security deposit. The card has a credit limit of $2,500. The card comes with balance transfer fees of 3% on the amount transferred, and a 3.3% foreign transaction fee.

Citi Secured Mastercard does not have an annual fee. It also has standard APR rates. For faster transactions, it comes with a contactless chip payment. It also offers special deals for travel, dining and entertainment. It's not the most popular credit card, but it does offer many benefits. Its cash-back program is small, but it can cost you a lot each year. The only issue with the card is its foreign transaction fee.