You've found the right place if you are looking for credit cards that allow borrowers with 600 credit scores. You'll find a list of the best credit cards based on your credit score, average utilization rate, and recent credit activity. This information will help you choose the right card for your needs.

Average utilization rate

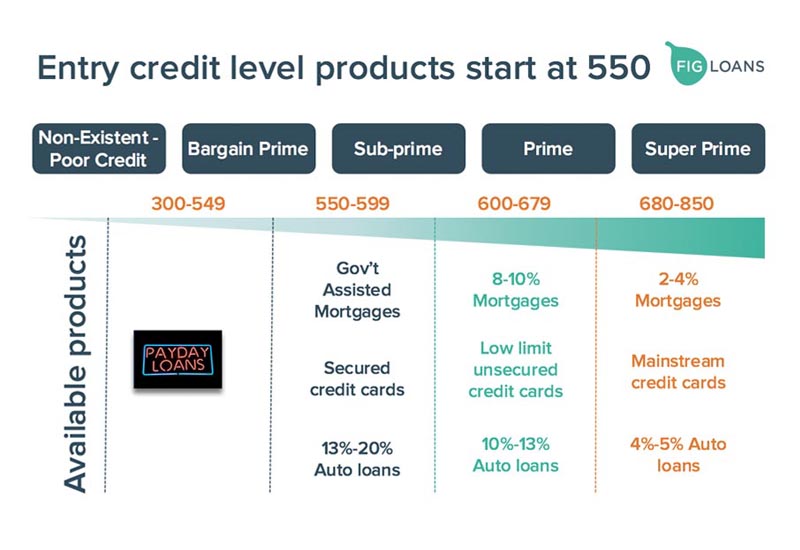

You might be wondering about the average credit utilization rate 600 for those who are considering taking out loans. It's actually 78.2%. This is much higher that the national average. Using less credit can be good for your credit score, but using too much can hurt your score. The optimal utilization rate should be below 30%. It really depends on how much credit are you using and your financial health.

Credit utilization rate (also known as the "revolving utilization ratio") is the most important measure in credit scores. Although it's simple to understand and can have a major impact on your credit score, it is important. You should consider ways to improve credit scores if you have high utilization rates.

Recent credit activity

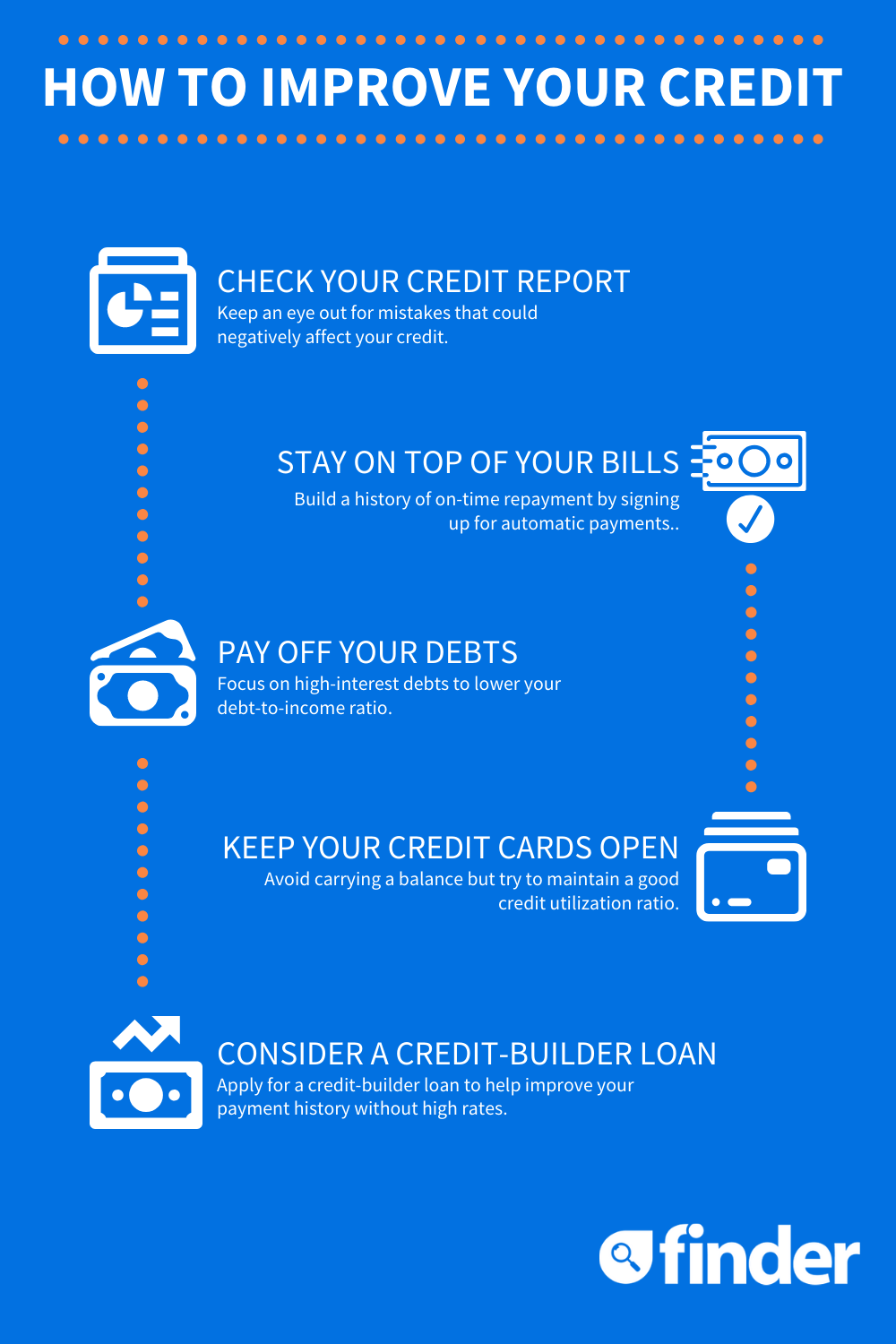

Recent credit activity has a negative impact on a 600 credit score, giving the impression that you are in trouble. Your credit score is usually affected by 10% of your recent credit activity. If you are able and able to make your payments on time, your credit score will improve. Do not apply for new credit cards. Instead, pay off all outstanding balances.

It is essential to improve your 600 credit score if you want to borrow money to finance a major purchase or start a new company. A high credit score can help you negotiate with lenders. They will consider you a good investment. Having a good score also helps you save money on interest costs.

Your debt can be reduced to improve your 600 credit score. This is possible by paying off all high-interest debts first.

Best credit cards for borrowers with a credit score of 600

If your credit score is above 600, you're on the right path. You can qualify for the best credit card options if you have a better credit score. However, there are still some options for those with lower scores. The Discover it Secured credit card has many benefits and is easy on your wallet. This credit card offers an unlimited 1% cashback, a refundable security deposits, and dollar to dollar matching on cash back.

The Applied Bank Secured Visa Gold Preferred Credit Card is easy to get approved for and has a low annual fee. This card is suitable for people with low credit scores as it does not require you to have a minimum credit score. The card reports automatically to all three credit reporting agencies, making approval easy. This card offers a rewards program that will help you build a good credit history within a short time.