Secured credit cards are credit cards that require you to make a refundable deposit before you can use them. These cards are often used as a stepping stone to an unsecured one, as they provide the lender with proof that you have a good credit history. A secured credit card requires that you make a deposit of a certain amount with the issuer. Be careful with your spending. You should limit the amount you spend on these cards to a couple of purchases per calendar month.

Secured credit cards require a refundable deposit

A small deposit is required if you have good credit and are willing to apply for a secured card. You can deposit as little as $250 to have more control of your cash than with a larger deposit. However, the security deposit is not refundable, and you may find it difficult to access it if you need it in an emergency. You may also have to cancel your card if your monthly payments are not being made.

Secured credit cards may be an option for those with bad credit or no credit. While these cards are not required to conduct credit checks, there may be higher fees. To get a refund, you will need to provide your bank account information. Sometimes, the issuer may give you a statement credit to pay for your new unsecured cards.

They are a stepping stone to an unsecured credit card

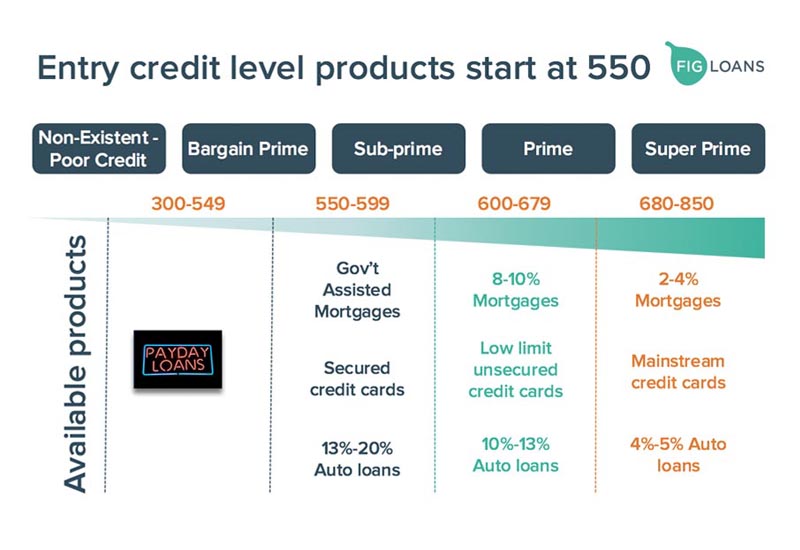

By making regular payments to your secured card, you can upgrade to an unsecured card. This will build your credit score to a level that will qualify you for an unsecured credit card from your card issuer. Typically, you should have a credit score of at least 580. Your credit utilization ratio should not exceed 30 percent.

Secured credit card cards are great for building credit and helping to develop good credit habits. You should remember that these cards will not be a permanent solution to fixing your credit. Many people end up upgrading to an unsecured card.

They provide proof that lenders need a good credit history

Secured credit cards are one way to establish credit history. The majority of secured card companies will not issue a card to anyone who has had a bankruptcy or is in debt. Bankrate’s CardMatch tool helps you determine whether you are eligible.

Some secured credit cards allow you to automatically increase your credit line after making on-time payments. This increases your purchasing power and improves credit scores. Lenders consider FICO scores of 670 or higher "good".

They are more accessible than unsecured cards

A secured credit card can be a great option for building credit. It is easier than unsecured cards and will help you build your credit. These cards require a deposit that the issuer will hold in an account to cover any costs if you don't pay the bill. These cards can also help people with bad credit build their credit history.

Unsecured cards are more difficult to get and carry a higher risk. Even for a small amount of credit, it may be difficult to get approved if your credit is poor or not good enough. Additionally, you may have to pay high fees that cannot be refunded. You might end up paying a higher APR than your credit score if you open an account.

They can help build credit

Secured credit cards are an excellent way to get started building your credit history. These cards will report your monthly data to the credit bureaus. This will help you build a positive credit history. You can build credit with a secured bank card by paying your bills on time. The longer you keep an account open, the faster you will start building a strong credit history.

You can improve your credit score by getting secured credit cards. However, you need to know how to use them. Pay your monthly bills on time, and don't spend beyond 30% of your credit limit. Secured cards are also useful if you have bad credit and are trying to rebuild it. They report to the credit bureaus every month and have low fees. There are very few annual fees for secured credit cards.