A combined score is the sum of your VantageScore and FICO scores. While it does not reflect the actual combined score of your credit history, mortgage lenders may consider these factors in addition to your overall score. However, you shouldn’t assume that the combined credit reports will yield a similar score. Each credit bureau uses its own scoring system.

VantageScore

VantageScore is a combination credit score that takes into account information from all three major credit bureaus about your credit history and payments. It also takes into consideration your payment history as well as available credit and age. VantageScore takes all these factors into account. However, FICO only takes one.

Your VantageScore combined credit score can be affected by recent credit activity, such as the opening of new accounts and credit inquiries. These are indicators of your financial health. Lenders love to see that you only take out the credit that you need. This means that paying off your debts on time will help your score.

FICO

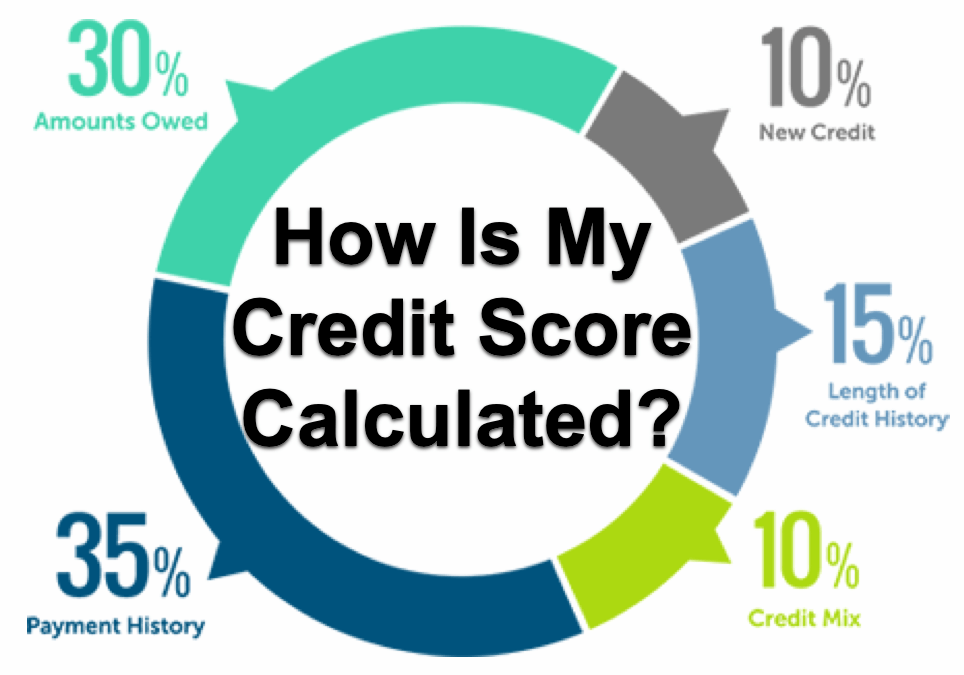

The FICO combined rating credit score is an important tool to homeowners searching for a loan. It is used to determine whether you can afford the mortgage. It's based on five categories, which can vary depending on credit history. Your score might be lower for someone with short credit histories than for someone with long credit histories. Your credit score is updated when new information is submitted to credit bureaus.

Lenders will also look at the length of credit history. This helps lenders get a more complete view of your credit history. This is a factor that typically results in a higher FICO credit score. It shows your ability to make timely repayments and keep a low credit utilization ratio. Your credit history is affected by many factors. These include the age of your oldest and most recent accounts, the average age and the length of time that each account has been open or closed.

VantageScore(r)

VantageScore(r), which is a combined credit scoring tool, uses data from all three credit bureaus in order to determine your credit score. Your credit score is affected by many factors. These include payment history and credit available. You can see a significant drop in your credit score if you miss or pay late. It is best to have several lines of credit that are long-standing and multiple account types. This will assist the lender in determining how responsible you are when it comes to credit.

Lenders use your credit score in order to determine whether you are approved for credit and whether you will be offered a particular interest rate. It also determines how much credit you can borrow. Lenders recommend keeping your credit score high to qualify for the best APRs. You will be able to get the best cards, with attractive rewards and annual statement credits.

Equifax

Equifax Credit Reports include a summary of credit history. Lenders can use this to determine your eligibility to receive a loan, college or other program. This includes information about your account terms and payment history. You should double-check the accuracy of the information in your credit report. If you see any inaccurate information, you can contact the creditor or lender to have it corrected. You can also file a dispute with the credit bureau in certain cases.

Your Equifax credit score is calculated using information provided by all three nationwide credit bureaus. Your score may be different from that of your credit cards company. The FICO score, meanwhile, is used by lenders to determine your credit worthiness.

TransUnion

You can improve your credit score in many ways. First, check your TransUnion credit report for any suspicious account information. Contact the credit grantor immediately if you discover any. Keep a record of the date, name, and company involved and follow up as needed. TransUnion will remove any inquiry that is found to be fraudulent.

A good credit score is 720 to 780 and above. Your TransUnion credit score will vary, depending on the lender and type of credit application. While a good credit rating does not automatically mean that you are approved for a loan/credit card, it can give you more freedom and flexibility.