A credit builder is a great tool to improve your credit and make it easier to obtain other loans, such a mortgage or a card with a favorable interest. But, before you apply for a credit building loan, it is important to know some things. Prior credit problems, such as bounced check, should be avoided. This will negatively impact credit scores. Late payments can lead to interest charges, which will lower your credit score.

The best way to build credit is with self-credit builders loans

Self-credit building loans allow the borrower to establish credit without having to do a credit check. They choose the term that best suits their needs and make monthly repayments until they get the amount they need. The loanee gets the money at the end of the term. This process can take between one and two weeks. Most lenders won't let a borrower take out more than one building loan at once.

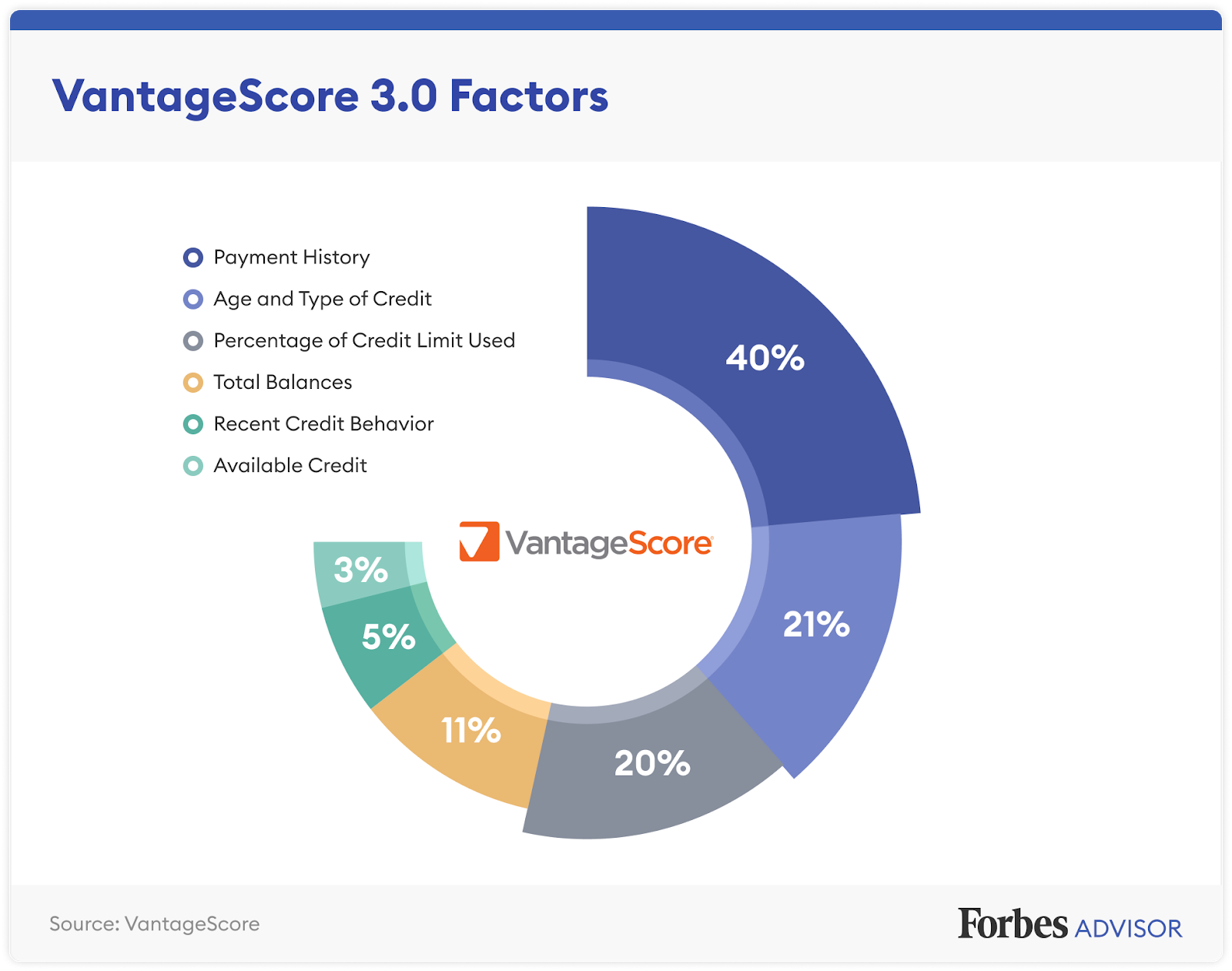

Self-credit builders loans can be very helpful for people with bad credit. Three-fifths to five percent of your FICO credit scores are determined by payment history. Therefore, it is crucial that you make timely payments in order for credit to grow. Self-credit builds your credit. They are affordable, easy to get, and don't require you to be a member of a credit union. You can improve your credit score with a self credit builder loan for as little $25 per month.

They will require that you pay the loan in full

A credit builder loan is a short term loan that can help you build credit. You will be required to make timely monthly payments for this type of loan. After the loan is paid in full, the lender will transfer the money to your bank account. Your credit score will improve as long as you pay all your bills on time.

While the amount that you borrow will be deposited into a bank account, it is not possible to access the money until your loan is paid back. Instead, the money is held by the financial institution, credit union, or online lender. It could be in a savings account, CD account, or other account. The initial application fee and administration fee may be required. Once you have established satisfactory repayment records, you will have access to your money at any moment.

They are easy to qualify

Credit loan builders are a type installment loan that will help you improve your credit score. This type of loan is designed to improve your credit score as well as lengthen your credit history. Petal1 is an example of a credit-builder loan. Petal1 will accept applications based on your credit score and banking history.

A credit loan builder can usually be a small loan of between 100 and 1000 dollars. The money borrowed is placed into a savings account and the borrower pays off the loan every month. These payments are reported by the lender to credit bureaus.

They offer low interest rates

Credit loan builders are a great option for those looking to improve their credit score. Because these loans carry lower interest rates and are less risky than traditional personal loans, they can be easier to obtain and more affordable for those with poor credit. These types of loans can be obtained from many banks and credit institutions. You can request information if you already hold an account or search for them online.

Paying your monthly payments is an important part of determining your FICO credit score. A borrower's score will be improved if they make timely payments. Late payments can cause a decline in their score. It is therefore important that you are able to afford the monthly payments. To avoid missing a payment you can set auto-pay through your primary account or set up phone reminders that remind you to pay.