You can apply to for a variety of credit cards. Some cards are intended for people who have poor credit while others can be used by people with little or no credit. Some cards are secured, which means you have to make a refundable security deposit before being approved. There are also student credit options.

Bank of America Travel Rewards Credit Card for Students

A Bank of America Rewards Credit Card for Students is an option for students looking to build their credit. There is no annual cost and unlimited 1.5 points per $1 on all purchases. There are no blackouts and no restrictions on airlines or baggage fees. You can also earn 25,000 points as a sign up bonus, which you can redeem for $250 in travel.

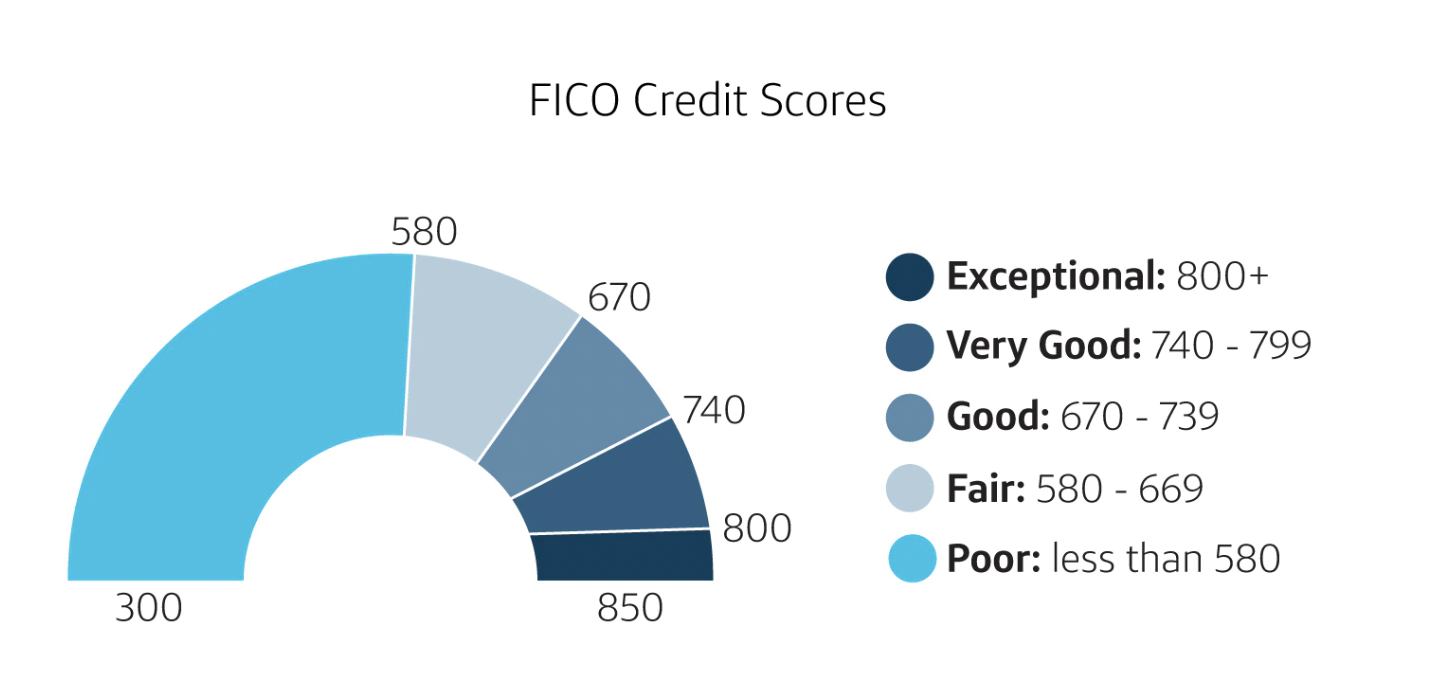

Online credit scoring can be checked online by applicants for this credit cards. You can learn the factors that impact your credit score. A credit score can be tracked and compared to national averages. This is particularly useful for those who are transitioning from college life to post-grad life. You will have better chances of getting approved for your first home and the best credit cards.

Foreign transaction fees should be known by students. These fees can add up fast, especially if students are abroad. However, students can still qualify for the $200 sign-up bonus if they make $1,000 in purchases within 90 days of account opening. The credit card also allows you to personalize your rewards. Cash back can be chosen from a variety of categories once per month. For example, 1.5 points can be earned for every dollar spent on home improvements, gas, or dining.

Discover it Secured Card Credit Card

A secured credit card can be a great way to improve your credit score. This card has a generous Welcome Bonus and a high cash-back program. It also allows for a seamless switch to an unsecured card after seven months. This allows you to build your credit and pay your bills on-time.

You will need to make a $200 deposit in order to open an account for the Discover it Secured Card. This amount is about the average range for secured credit card cards. However, you should keep in mind that you'll have to pay a balance transfer fee of up to five percent of the transfer amount after six months. This fee, however, is relatively low compared with the benefits this card offers.

A generous welcome bonus is included with the Discover it Secured Card. The company will match $200 of the cash you earn during your first year. That's fantastic because it means that your credit score can improve if your bill is paid on time.

Petal 2 Visa Credit Card

The Petal 2 Visa Credit Card by Visa Credit Card isn't the best credit card to build credit. However, if you want a card that doesn't charge any fees and offers rewards for purchases, this card could be a good option. You get 1.5% cashback on eligible purchases and no annual fees. It is specifically designed for those with low to moderate credit ratings.

Petal 2 Visa Credit Card: The issuer will run a credit check on your credit history. This will be done based on your bank history and digital financial records. You will be declined if your credit score is not good. In order to avoid any interest charges, it is important that you pay the entire amount in full by the due date.

Petal 2 Visa Credit Card is a great way to build long-term credit. It features budgeting and credit surveillance. It's also a good choice for a first card, and it's designed specifically for people looking to build credit.