Credit scores are an important tool for lenders. They assist lenders in making informed decisions about who they loan to. They can also determine a borrower's creditworthiness to help them avoid bad loans. It is important to maintain a high score. However, it's important to know what factors affect your credit score.

Factors taken into account when calculating credit score

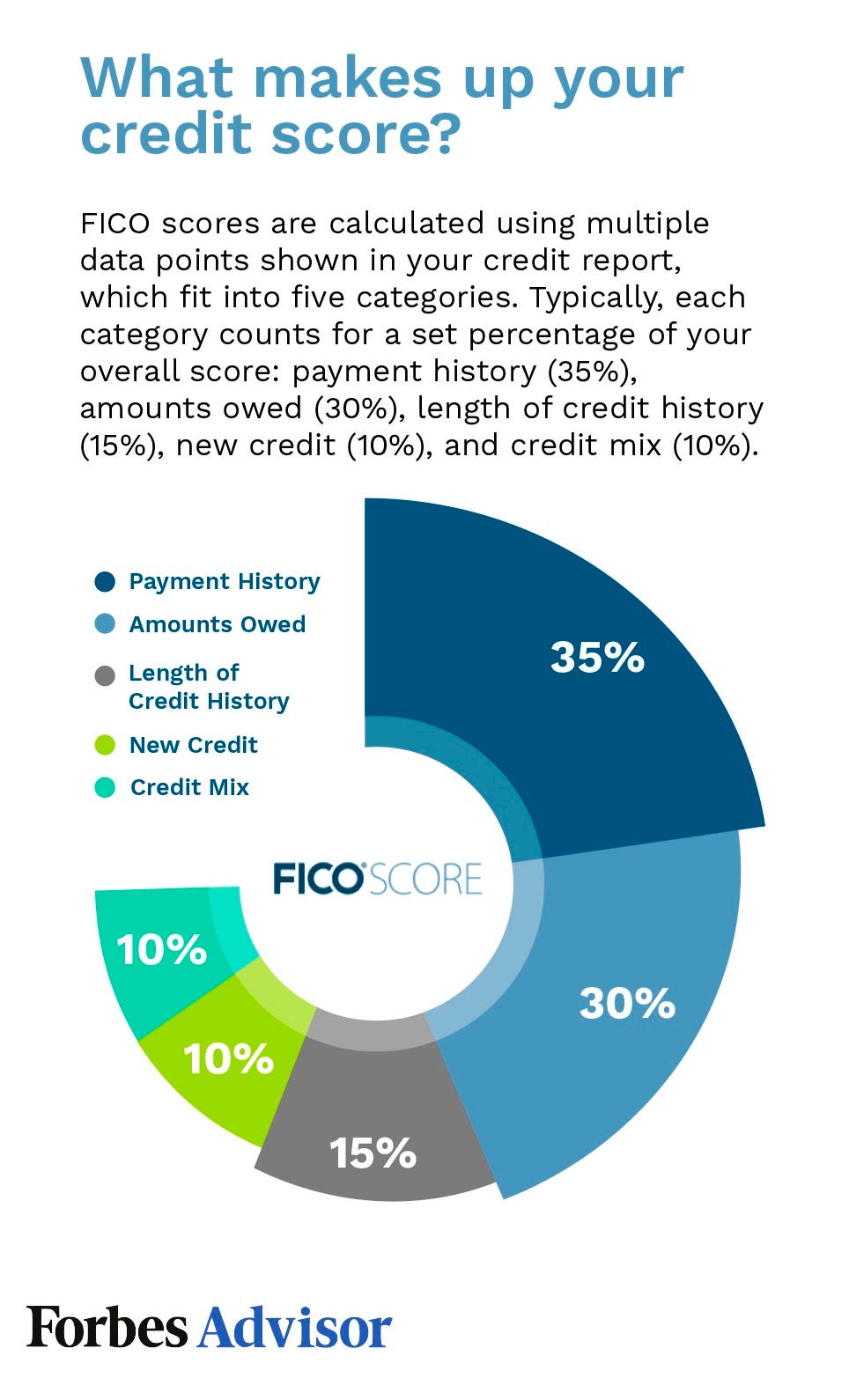

Your credit score is based on a combination of factors. The first two factors, your payment history and the length of your credit history, account for nearly two-thirds of your total score. Your credit score will rise the more you have credit history. This is why it is crucial to pay your bills on time. Your credit score also takes into account the types of accounts you have. It is best to keep as many accounts as possible.

It will be easier to plan ahead if you keep track your credit accounts. FICO considers not only your age but also the type of each account. FICO scores that are higher for those with a longer credit history will have lower FICO scores. A variety of accounts will improve your credit score.

Good credit scores can have an impact on your financial health

A good credit rating will make you more financially secure and open up many opportunities. For starters, a high score can increase the chances of getting approved for a loan. Lenders will consider your credit score when determining your creditworthiness. This will affect the interest rate and terms of your loan.

Your insurance and mortgage rates can be reduced by having good credit. You will also save money. It will also help you qualify for a higher credit card limit and lower insurance rates. It is a smart idea to check your credit reports regularly and see how it affects your finances.

Credit scores are a powerful indicator about the health of a community. They may be an accurate reflection of the risk tolerance and ability to manage complex processes. Individuals with higher credit scores are more likely to be involved in car crashes than those who have lower credit scores. Also, higher credit scores were associated with higher financial literacy and fluidity. In the end, credit scores can be a proxy of economic and social factors.

It is vital to maintain a high credit rating

Having a good credit score can benefit you in many areas of life. Not only can you obtain a loan on favorable terms, but your credit will also help you handle your finances more responsibly. This can lead to better job prospects. Low credit scores can be deterrents for some.

To build a good credit score, you need to regularly monitor your credit history. Checking your score and credit history is essential for future loan applications, as it provides lenders with important information about how you handle credit. Avoid making mistakes that could lower your score. Avoid late payments, closing accounts that are no longer in use, and avoiding inquiries to your credit reports.

The amount of debt you have is another factor that can affect your credit score. The lower your credit score, the more debt you have. Limit your credit to 30 percent. Do not borrow more than you can afford. Pay down your balances quickly and keep your credit cards' balances low. This will allow you to reap the rewards of having a good credit score.